This is an event that can change your life...

Saturday, January 10th, 2026 | Registration starts at 10am

In Person | 2957 Stelzer Rd, Columbus, OH 43219

** Seats are limited reserve your spot now! **

Let’s talk about the money first...

You will see the real numbers.

What buying actually costs.

What renting really costs over time.

Where your money goes when you rent.

Where it goes when you own.

No estimates pulled from the air.

No vague promises.

Just math you can understand.

If you are tired of the rent cycle

Rent goes up.

You start over every year.

You pay on time.

You do everything right.

And still walk away with nothing.

If you feel stuck in that loop, you are not alone.

This workshop shows you how people step out of it, without rushing and without guessing.

You may not need as much cash as you think

Many buyers delay buying because they believe they need a large down payment.

That is often not true.

There are down payment assistance programs available, but most people never hear about them.

In this workshop, you will learn:

What down payment assistance really is

Who may qualify

How it works with real loan options

When it helps and when it does not

If support exists, you deserve to know about it.

Why buying now deserves a real conversation

Waiting feels safe.

But waiting can also be expensive.

You will learn:

How timing affects your buying power

What interest rates actually mean for your monthly payment

Why waiting for “perfect” often delays progress

This is not about pushing you to buy.

It is about helping you decide with clarity.

For homeowners thinking about selling

Selling is not just about listing a house.

It is about timing.

Numbers.

Next steps.

You will learn:

How to understand your equity clearly

What selling now versus later may look like financially

How to plan your move without pressure

Good decisions start with good information.

A real story. Real numbers.

Bryan was not an investor.

He was a regular person with a job and responsibilities.

He wanted out of renting.

He wanted stability.

He wanted a better next step.

Instead of rushing, he learned how to buy with intention.

That decision gave him breathing room.

It gave him flexibility.

It gave him options.

Not because of luck.

Because of understanding.

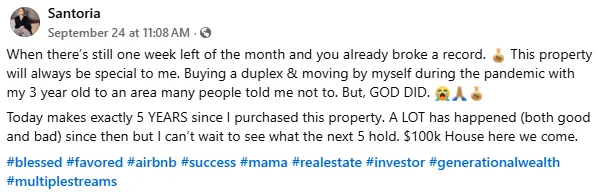

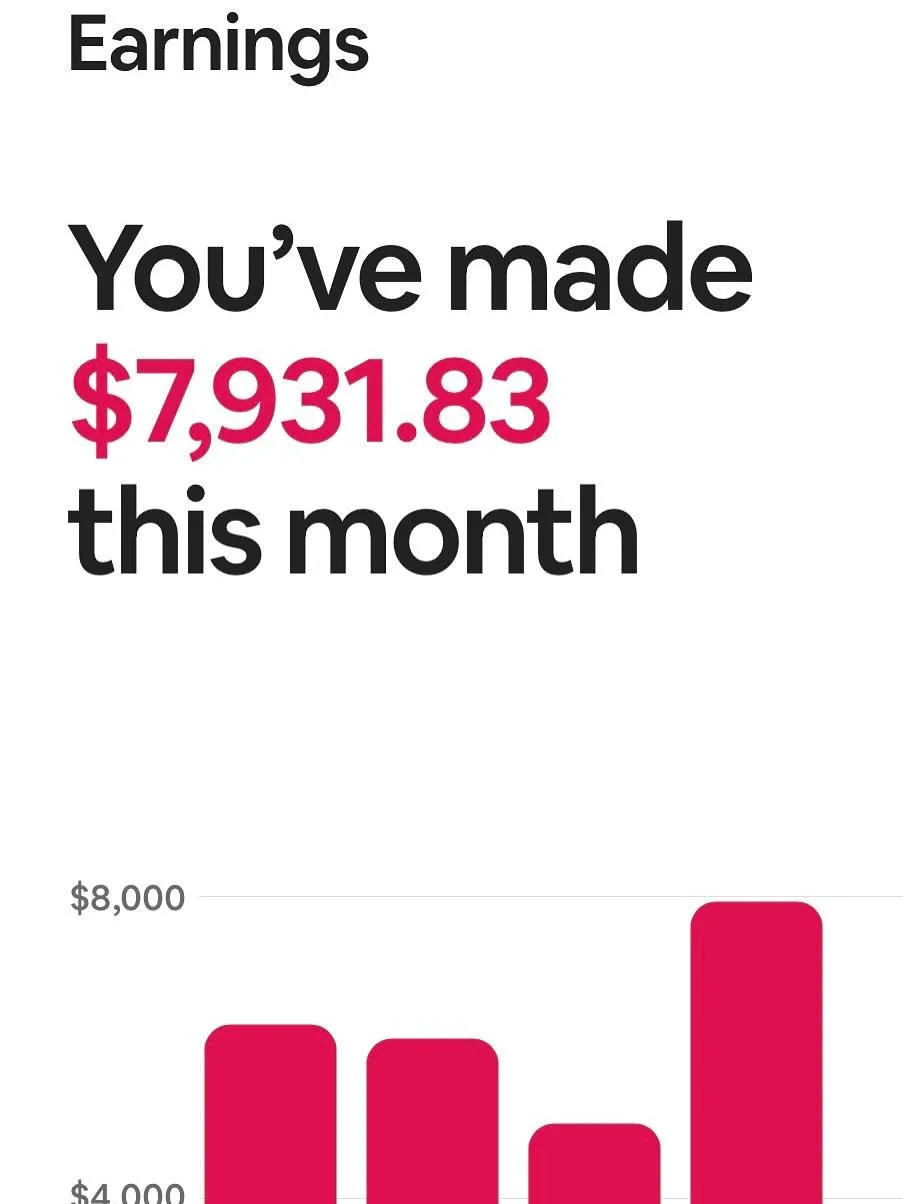

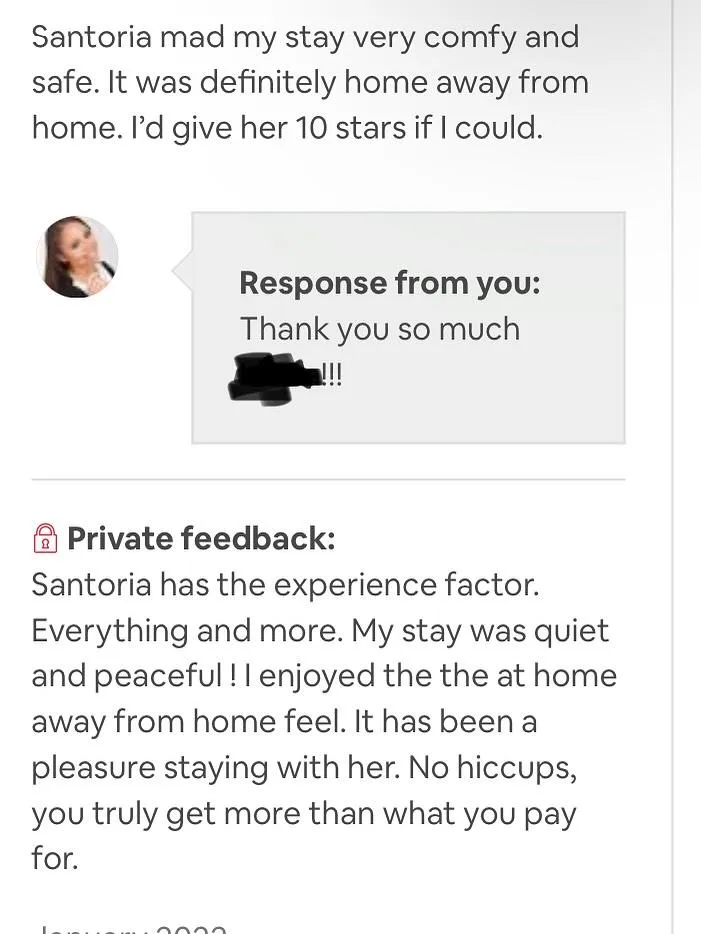

See how Santoria went from stuck to building real cashflow after attending in one of our It's Time To Own It Workshops...

It’s Time to Own It Will Cover:

Real Success Stories: Hear from people just like you who made their dreams happen. You can too.

Where is the Money? Get the inside scoop on $25k and $15k grants and who qualifies for them. This could be your golden ticket.

Cash Needed to Close: "No money down" doesn’t mean no expenses. I’ll help you understand the real costs so there are no surprises.

Finance Breakdown Segment:Learn the difference between FHA, VA, and Conventional loans. We’ll break down what these mean and which one might work best for you.

Why Owning Beats Renting Every Time: Stop throwing money away on rent and start building something for yourself. I’ll show you how.

Boost Your Buying Power: Credit score a little shaky? We’ll talk about how to improve it and why it matters when buying a home.

Save $75,422 in Interest Charges: We can show you how to do this.

The Buyer Broker Agreement: Don’t skip this step. I’ll explain why having a buyer broker in your corner is key to a smooth purchase.

The first step to experiencing significant change is getting the information and then using that information to take massive action. Get your ticket here today. I will see you on Saturday, January 10th, 2026.

Carl’s story proves this works. Yours could be next...

Get Your Ticket Here

general admission

$29

Attend the workshop virtually via ZOOM or In Person | 2957 Stelzer Rd, Columbus, OH 43219.

Covers the core training or content presented during the event

MORE TESTIMONIALS

Don’t just take our word for it. Gustavo is living proof this seminar changes lives.

Alyssa made the move, and it paid off. Will you?

Her mom’s lessons set the foundation, the Buy Right System showed Paris how to turn it into results.

One ticket changed Arielle’s outlook. Yours is waiting.

"Theresa is a visionary"

"This is a fabulous organization. I attended a workshop here and it was absolutely next level! Theresa is a visionary. Delicious dinner was served too!" - B. Blacksmith

"I was impressed"

"I was there to present at an investors and first-time home buyer seminar. I was impressed that the focus was on self-improvement and people bettering themselves.." - Jim Troth

"I am paying less than rent"

"I attended a seminar and within 6 months purchased my own home. Thanks for the information and thanks to Mr Larry Radcliff for showing me houses that I asked to see. I had 3-4 to choose from before we made an offer. I am paying less than rent and again. Thank you.." - Steph Clayton

"I left with resources and more knowledge"

"My wife and I went to the Homebuyers Workshop. The ladies did a phenomenal job introducing and teaching the group a basis of the process of home buying. I left with resources and more knowledge than what I walked in with. Thank you ladies. And they fed us GOOD FOOD!" -Kendra Spencer

Change starts the moment you gain the right knowledge and act on it with bold steps.

Secure your ticket today and take that first move toward transformation.

MEET THE founder

Hey, I'm Theresa Barron

I’m the founder and visionary of It’s Time to Own It. My journey began at 22, when I was a single mom renting a townhome in Columbus, Ohio. In 1989, I realized rent only goes up, and landlords don’t care about your struggles.

Then, I met Sam Ligon, an independent broker who shared life-changing knowledge. I purchased my first home on January 15, 1989. I purchased my second home September of 1990. And I purchased my third home February of 1991— and I never sold any of them to purchase.

Four years later, I earned my real estate license. I juggled a full-time job, school, and motherhood but stayed committed. By 1997, I met another mentor, an independent broker, who gave me the tools to leave my bank job for good. I haven’t worked for anyone else since May 1997.

In 1998, my mentor and coach took me from $40k to $100k in just 6 months—that is the power of being coached—let me be your coach.

I have been serving buyers and sellers for the last 32 years.

I have trained hundreds of agents and investors to make smart moves with my Ownership to Cashflow System.

At the end of the day, what we all want is more time with the people we love, more freedom to do what we want and more money freedom to be able to live the life we want to live.

Let me help you break free from the rent trap.

xoxo,

Theresa

Buy Right. Build Cash Flow. Live Free. Reserve Your Seat.

Copyrights 2025 | It's Time To Own It™